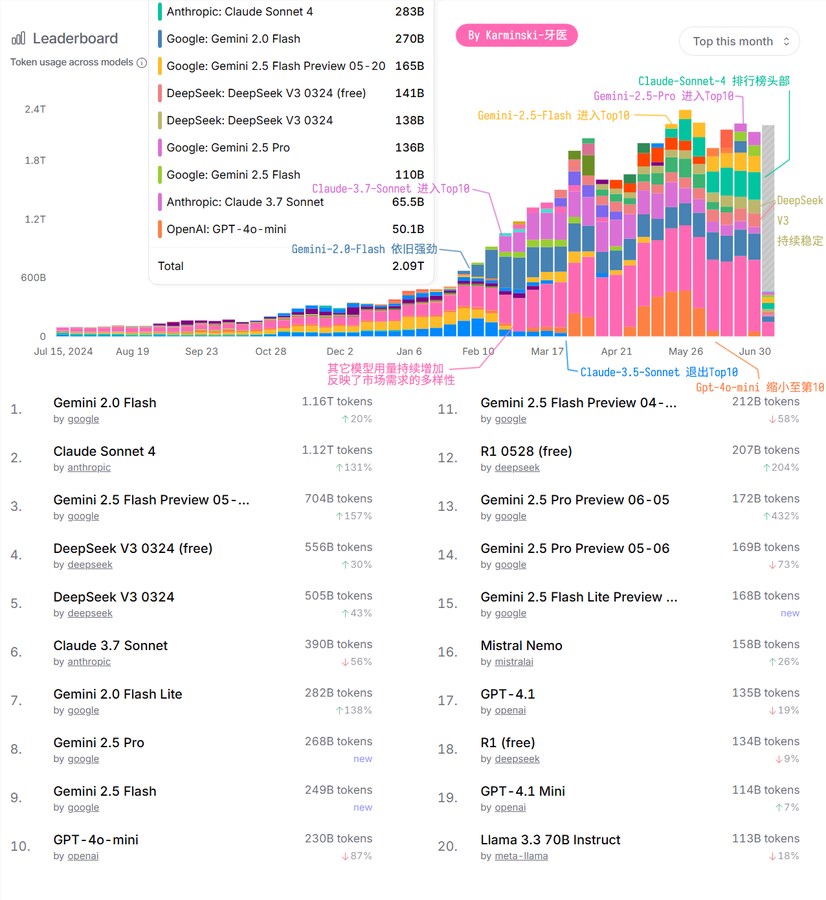

The first half of 2025 has passed, and the competition in text generation large models has entered a fiercely intense stage. The AI API market is rapidly evolving, with Google's Gemini series, Anthropic's Claude series, and DeepSeek among the players engaging in fierce competition. Based on the latest data from OpenRouter, AIbase provides an in-depth analysis of the latest trends and future directions in the AI API market in the first half of 2025, revealing who the true "service king" is.

Gemini series leads strongly, while DeepSeek makes a sudden rise

According to data from the OpenRouter platform in the first half of 2025, Google's Gemini-2.0-Flash, with its high cost-effectiveness (only $0.4 per million tokens output) and fast response capability, remains the most popular model. Following closely is Anthropic's Claude-Sonnet-4, ranking second. Gemini-2.5-Flash-Preview-0520, benefiting from its late entry, has climbed into third place. Notably, if the data from both the free and paid versions of DeepSeek-V3 are combined, its total usage can rival that of the second place, demonstrating strong market competitiveness.

Image source: karminski - Dentist

Since its launch, DeepSeek-V3 has consistently occupied a spot in the Top 10, thanks to its high performance and low price, with a high user retention rate. Especially in programming and reasoning tasks, DeepSeek's performance is commendable, and in some scenarios, it even approaches the level of Claude-3.5-Sonnet, making it a popular choice in the developer community.

Market stabilizes after the boom, highlighting diverse demands

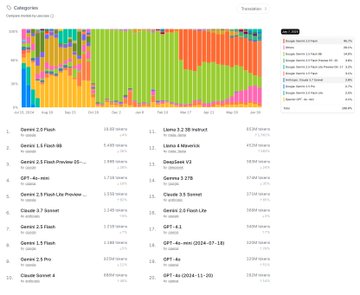

In the first quarter of 2025, the AI API market experienced explosive growth, with the total token usage on the OpenRouter platform increasing by four times. It then stabilized at around 2 trillion tokens per week. This phenomenon indicates that the demand for AI large models has shifted from an initial boom to a stable development phase. The usage of other non-top models remains between 600 billion to 700 billion tokens, reflecting the diversity of the market and the growth of niche demands. The active performance of long-tail models highlights the differentiated needs of developers for model performance in different scenarios.

Image source: karminski - Dentist

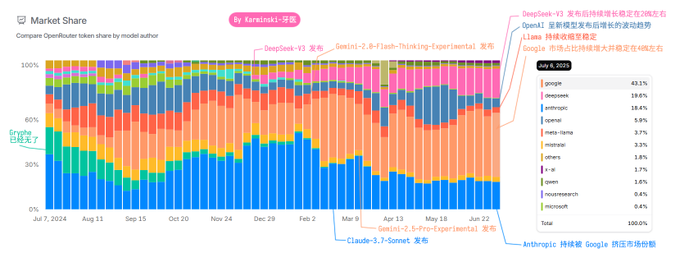

Google's strategy is precise, while the Claude series transitions smoothly

Google's layout in the Gemini series is highly accurate. Gemini-2.0-Flash, with its low price and efficiency, firmly occupies the leading position in the market. Gemini-2.5-Flash, as a subsequent iteration, shows strong potential. Once it lowers its price, it is expected to fully replace the previous version. In contrast, Gemini-2.5-Pro, which replaced the experimental version, has limited growth in usage, indicating that Google still needs to optimize its layout in the premium model market.

Anthropic's Claude series has experienced a smooth transition. Claude-3.5-Sonnet and Claude-3.7-Sonnet have gradually stepped out of the historical stage, and Claude-Sonnet-4, taking over, has maintained stable market performance but has not achieved significant growth. This indicates that while Anthropic maintains the competitiveness of its premium models, it faces great pressure from low-cost models.

Image source: karminski - Dentist

OpenAI's market performance fluctuates, GPT-4o-mini shows inconsistency

To everyone's surprise, OpenAI's models did not perform stably in the first half of 2025. GPT-4o-mini saw a sharp increase in usage in May, showing the short-term effectiveness of marketing efforts, but overall usage fluctuated significantly, failing to maintain a leading position in the Top 10. This may reflect that OpenAI has shifted its strategic focus in the API market, failing to fully meet the diverse needs of developers.

Future outlook: Price wars and performance optimization go hand in hand

In the first half of 2025, the competition in the AI API market has shifted from a simple performance race to a comprehensive competition involving price and performance. Google has captured the market through its low-price strategy, while DeepSeek has rapidly risen by leveraging its open-source advantages and high cost-effectiveness. Meanwhile, OpenAI and Anthropic need to make more efforts in price adjustments and ecosystem optimization. In the future, as model performance continues to improve and market demands become more segmented, AI API services will be more focused on scenario-based applications and the construction of developer ecosystems.

AIbase's view: The "second half" of the AI API market has begun, and cost-effectiveness and ecosystem layout will become key to success. When choosing models, developers and enterprise users should not only pay attention to performance and price but also consider long-term ecosystem support and the adaptability of application scenarios. In the second half of 2025, the competition among large AI models will become even fiercer. Who will ultimately win this "battle for supremacy"? AIbase will continue to provide you with updates!