According to China Securities Times, Hangzhou Unitree Technology Co., Ltd., a leading humanoid robot company in China, officially started its listing counseling on July 18, with CITIC Securities as the counseling institution, marking a key step for the company toward an IPO on the A-share market. This move not only recognizes Unitree's own innovation capabilities but also signals that the humanoid robot industry is entering a new phase of accelerated development.

Unitree's appearance at this year's Spring Festival Gala helped it quickly go viral, significantly boosting its popularity. Recently, the company was selected as one of the 10 winners of the WIPO Global Awards 2025, becoming the only Chinese representative among them, achieving a breakthrough for Zhejiang Province in this award. This international honor highlights Unitree's innovative capabilities in core areas such as robot motion control, high-performance joint motors, and real-time systems, as well as its global intellectual property strategy.

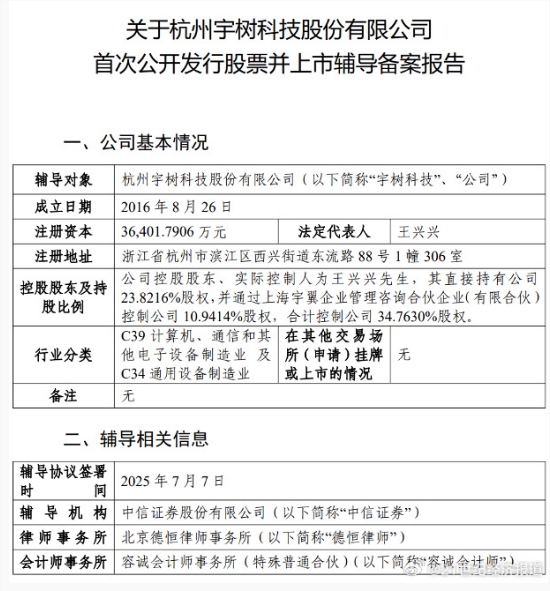

To prepare for this IPO, Unitree has completed its shareholding system reform, changed its name to "Hangzhou Unitree Technology Co., Ltd.," and increased its registered capital from less than 3 million yuan to 364 million yuan in June, laying the foundation for the IPO.

The rise of Unitree has been driven by the support of capital. Previously, the company received joint investment from well-known enterprises such as Geely Auto, Tencent, Alibaba, and Ant Group. In early July, the Beijing Robot Industry Development Investment Fund also made an additional investment in Unitree, demonstrating strong market confidence in its future growth potential.

Unitree's initiation of an IPO is undoubtedly a positive development for related A-share listed companies. According to data from Databao, companies such as Wulong Electric Drive, Jinfat Tech, Xuelong Group, and Shoukai Property have indirectly invested in Unitree. As of July 18, the average stock price increase of these indirectly invested companies this year exceeded 18%, with significant gains in Xuelong Group, Wulong Electric Drive, and Zhongji XuChuang. At the same time, multiple stocks related to humanoid robots, including Zhongji XuChuang, Jinfat Tech, and Wulong Electric Drive, have seen large-scale capital inflows from financing clients, showing strong investor interest.