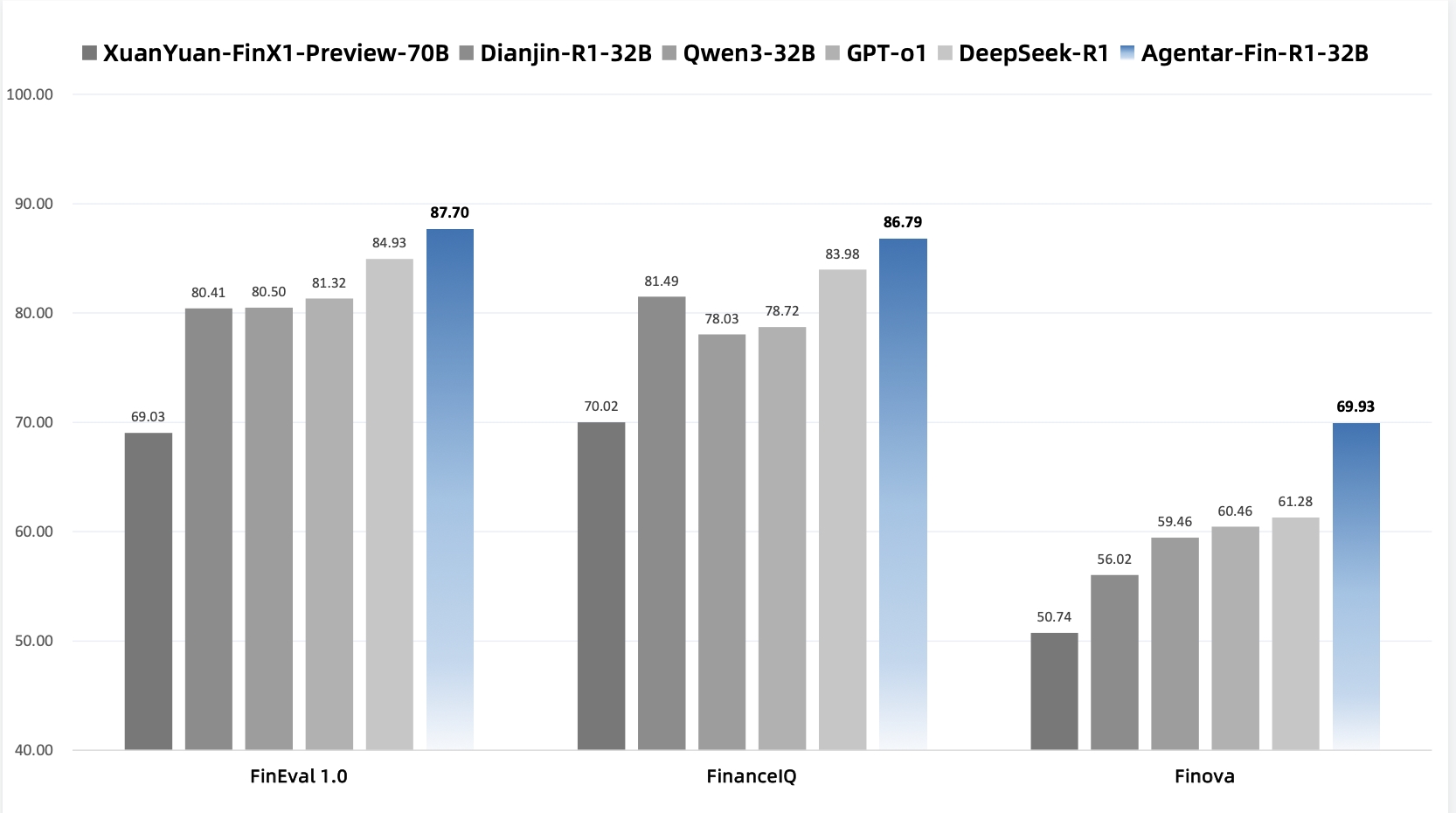

On July 28, at the World Artificial Intelligence Conference forum, Ant Digital officially launched the financial reasoning large model Agentar-Fin-R1, creating a "reliable, controllable, and optimizable" intelligent core for financial AI applications. Agentar-Fin-R1 is based on Qwen3 and has surpassed deepseek-r1 and other open-source general large models of similar size as well as financial large models on authoritative financial large model evaluation benchmarks such as FinEval1.0 and FinanceIQ, demonstrating its stronger financial expertise, reasoning capabilities, and security compliance.

With the accelerating digital and intelligent transformation of the financial industry, the application of large models in the financial field continues to deepen. However, in practical business scenarios, high-level financial knowledge, complex business logic reasoning abilities, and strict financial-level security compliance are often required. Existing large models still face many challenges in solving real financial tasks.

"There exists a 'knowledge gap' between general large models and industrial practical applications. Building specialized financial large models is an inevitable path to promote the deep integration of finance and AI. In the future, the depth of application of financial large models will become a key element of competitiveness for financial institutions," said Zhao Wenbiao, CEO of Ant Digital, in his speech.

It is reported that Ant Digital has built a comprehensive financial task data system and innovated model training algorithms, achieving stronger financial reasoning capabilities and reliability. Evaluation results show that compared with general open-source models and other financial models, Agentar-Fin-R1 achieved the highest scores on two mainstream financial benchmark tests, FinEval1.0 and FinanceIQ. At the same time, the model demonstrates high-level performance in both financial and general capabilities.

In terms of data, Ant Digital has built the most comprehensive and professional financial task classification system in the industry, covering six major categories and 66 subcategories, including banking, securities, insurance, funds, and trusts. Based on a trillion-scale financial professional data corpus, through trusted data synthesis technology and a mechanism for constructing long-term thinking chains (CoT) with expert annotations, the model's ability to handle complex tasks has been significantly improved, making large models "naturally understand finance and be experts from the factory."

In terms of training, the innovative weighted training algorithm improves the learning efficiency and performance of large models for complex financial tasks. In subsequent business applications, it can significantly reduce the need for secondary fine-tuning data and computing power consumption, effectively lowering the threshold and cost of deploying large models in enterprises. Additionally, Agentar-Fin-R1 can continuously update and iterate, absorbing the latest financial policies, market dynamics, and other critical information, and through supporting evaluation tools, it can perform targeted optimization, allowing the model's capabilities to evolve continuously in real business scenarios.

It is reported that Agentar-Fin-R1 includes two versions: 32B and 8B parameters. Ant Digital also introduced a MOE architecture model based on the Bai Ling large model, achieving better inference speed. In addition, there are non-inference versions of 14B and 72B parameter large models to meet the deployment needs of financial institutions in various scenarios.

To evaluate the ability of large models to be deployed in actual financial scenarios, Ant Digital jointly launched the Finova large model financial application evaluation benchmark with institutions such as China Industrial Bank, Ningbo Bank, the Beijing Frontier Financial Regulatory Technology Research Institute, and the Shanghai Artificial Intelligence Industry Association. This benchmark deeply examines the capabilities of intelligent agents, complex reasoning, and security compliance. Agentar-Fin-R1 also achieved the highest score in the Finova evaluation, even surpassing larger parameter scale general models. Currently, Finova is fully open-sourced, promoting the industry to collectively improve the application level of large models in the financial field.

Ant Digital is an independent technology subsidiary of Ant Group, dedicated to helping industries achieve digital and intelligent upgrades using AI and Web3 technologies. This year, Ant Digital has accelerated its layout in enterprise-level large model services, focusing on the financial and new energy sectors. In the financial field, Ant Digital previously launched the financial intelligent agent platform Agentar, becoming one of the first products to pass the evaluation by the China Communications Standards Association and receiving the highest rating of 5. Ant Digital has also collaborated with industry partners to launch over 100 financial intelligent agent solutions, accelerating the large-scale application of large models in the financial industry.

For example, in Shanghai, Ant Digital helped a local bank develop an AI mobile banking app, innovating the "conversation as a service" model. Users can access various financial services through natural conversations, significantly improving the satisfaction of elderly customers and increasing monthly active users by 25%. Currently, Ant Digital has served 100% of state-owned banks and joint-stock commercial banks, more than 60% of local commercial banks, and hundreds of financial institutions.