Stripe, a financial services platform, has released its latest analysis report, delving into the payment data of the top 100 AI companies on its platform, revealing that the AI economy is experiencing unprecedented growth and showing significant trends in revenue growth, global market expansion, and business model innovation.

As a financial services partner for well-known AI companies such as OpenAI, Anthropic, Midjourney, and Cohere, Stripe has unique insights into how AI startups are accelerating the transformation from "user demand" to "company revenue" in this technological wave.

The report points out that the rapid development of the AI economy is primarily driven by three key trends:

AI startups achieve revenue milestones at a speed that surpasses any previous generation of tech companies, including SaaS companies;

AI companies simultaneously expand into international markets from the beginning, possessing a "natively global" gene;

and an endless stream of innovative business models and monetization strategies, accelerating revenue growth and market adoption.

Revenue Growth Enters "Rocket" Mode

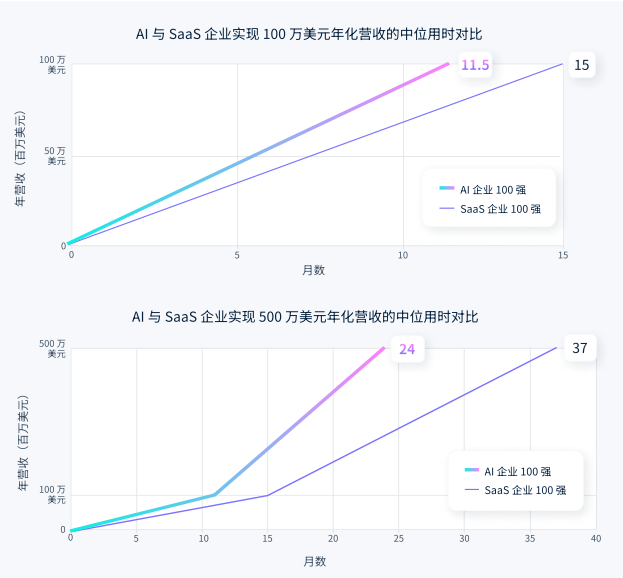

The speed at which AI companies reach key revenue milestones far exceeds expectations. The median time for the top 100 AI companies on the Stripe platform to achieve a 1 million USD annualized revenue was only 11.5 months, four months faster than the fastest-growing SaaS companies. When reaching 5 million USD annualized revenue, the median time for AI companies was 24 months, while SaaS companies required 37 months, making AI companies nearly one year faster in this aspect.

Notably, young AI companies established between 2020 and 2023 have shown astonishing revenue performance: achieving 1 million USD annualized revenue in just 5 months, and 5 million USD annualized revenue in 13 months. This is more than 11 months and 28 months shorter than AI companies established before 2020, reducing the average time required by over two-thirds.

Strong market demand is the fundamental reason behind this accelerated growth:

- In 2023, the percentage of global enterprises adopting AI technology was 55%, and by 2024, it had risen to 72%.

- The enterprise adoption rate of generative AI doubled during the same period.

- By August 2024, the personal user adoption rate of AI in the United States was roughly twice that of personal computers and the internet during their respective developmental phases.

The report highlights numerous cases of rapid growth:

- Bolt: A platform that allows users to create, run, edit, and deploy full-stack web and mobile applications through prompts, achieved 20 million USD in annual recurring revenue in just 2 months.

- Lovable: A tool that enables users to build high-quality software without coding, reached 17 million USD in annual recurring revenue in just 3 months.

- Cursor: An AI-powered code assistant, achieved over 100 million USD in annual recurring revenue within 3 years.

Natively Global: AI Market Penetration Without Borders

Differing from the traditional path of startups first focusing on local markets before expanding internationally, AI companies are breaking conventions, possessing an international gene from the start.

Data shows that the top 100 AI companies on the Stripe platform covered twice as many countries in their first year as SaaS companies (AI companies averaged 55 countries, while SaaS companies averaged 25 countries). This leading advantage continued in the following four years, for example, by the fourth year, AI companies averaged 104 countries, while SaaS companies averaged 57 countries.

Global demand for AI products has seen explosive growth, with some of the fastest-growing regions being unexpected, such as Iceland, Estonia, Luxembourg, Switzerland, and Singapore, rapidly becoming emerging hotspots with the highest per capita AI procurement density. For example, Midjourney had already covered more than 200 countries and regions by 2024, surpassing all other Stripe users.

Business Application Landscape: From General to Vertical, Innovative Monetization Abounds

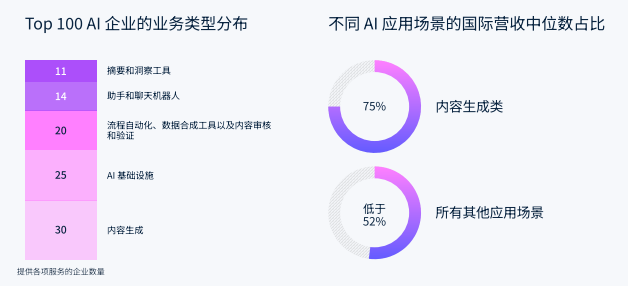

Currently, most AI companies still focus on general industry tools. Among the top 100 AI companies on the Stripe platform, 80 provide horizontal applications such as content generation, chatbots, or AI infrastructure, without focusing on specific industry scenarios.

However, the report also observed a clear shift trend: AI companies are gradually moving towards customized solutions tailored to specific industries, aligning with the development path of early SaaS models.

These verticalized products are not merely wrappers around large language models (LLMs), but rather "native" intelligent tools deeply embedded in industry workflows, data systems, and contextual scenarios. Examples include:

- Healthcare: Abridge, Nabla, and DeepScribe

- Real Estate Marketing: Studeo

- Construction Industry: SketchPro

- Restaurant Reservations: Slang.ai

- Property Management: HostAI

- Legal Field: Harvey Company's AI legal assistant, which saw its revenue grow by four times in 2024 alone and was adopted by numerous Fortune 500 companies.

As the AI industry matures, companies are accelerating the exploration of more diverse monetization paths. In addition to traditional subscription models, usage-based billing and outcome-based billing models are becoming increasingly popular.

Usage-Based Billing: Charging based on the duration, data volume, or number of API calls made by customers using AI services. This model ties pricing to service costs and lowers the entry barrier for customers. For instance, collaboration analytics platform Hex implemented a usage-based billing model via Stripe, processing over 500 million billing events in just a few months after launch, significantly improving operational efficiency.

Outcome-Based Billing: Customers pay only when the AI produces actual results. This model is particularly suitable for agentic workflows, significantly reducing customers' initial investment risks and encouraging more enterprises to try using AI.

Although usage and outcome-based billing models face challenges in revenue predictability, more and more AI companies are introducing prepaid models to alleviate cash flow pressure and improve revenue predictability, especially beneficial for early-stage AI startups.

Rise of Agent Commerce: AI Redefining Transactions

AI is not only changing the way companies sell content but also redefining transaction methods. AI agents are gradually taking over traditional manual tasks such as product research, order placement, and subscription management, executing them autonomously. For example, ElevenLabs uses voice-automated AI agents to handle subscriptions and refunds; Perplexity and Payman have achieved seamless payments driven by AI.

This transformation will profoundly change the way companies interact with customers, transaction processes, and underlying business logic. It not only requires updating commercial and pricing models (such as usage-based billing, outcome-based payments, or value-based pricing) but also demands that companies equip themselves with secure and autonomous transaction technologies to match the increasingly important role of AI agents in financial decision-making.

Companies generally view agent commerce as a future direction. According to Stripe's latest survey, 53% of global corporate executives say they are preparing for agent commerce, and when asked about the importance of agent commerce in the next two years, 63% of respondents gave a rating of 7 or higher (on a scale of 10).

Thousands of developers have begun integrating payment tools built around AI agents. Stripe's agent development toolkit is downloaded thousands of times per week, and hundreds of agent startups launched operations on Stripe in 2024, with projections that this number will further increase in 2025.

Stripe helps AI companies quickly launch, flexibly monetize, and expand globally by providing comprehensive financial infrastructure, including fast company registration, accelerated revenue milestones, native global support, flexible pricing models, and automated fraud prevention and tax compliance. The virtuous cycle of the AI economy—capital investment, technological innovation, and global expansion—is accelerating, signaling a vibrant intelligent future.