While Wall Street was still working late into the night modeling, an efficiency revolution driven by AI has quietly arrived. Anthropic recently made a major upgrade to its finance-specific version of Claude, introducing three killer features: native Excel interaction, real-time data connection to global financial markets, and an investment-grade intelligent Agent skill set. These features directly address the most painful issues for financial professionals—“data moving + repetitive modeling”—and have been called “the second brain for analysts” in the industry.

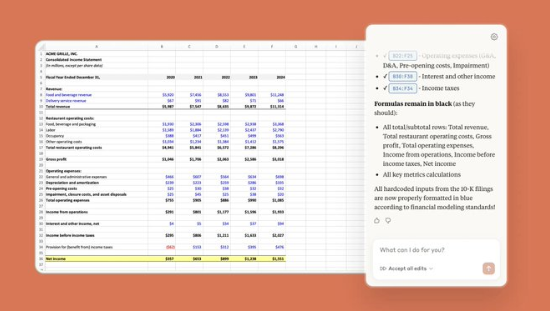

The most disruptive breakthrough is Claude for Excel. In the past, analysts had to switch back and forth between Bloomberg, PitchBook, internal databases, and Excel, manually copying and pasting hundreds or even thousands of lines of data. Now, Claude can read, calculate, and model directly within the Excel interface. All you need to say is “Build a DCF model for Apple based on the latest financial statements,” and it will automatically retrieve financial data, calculate WACC, and generate a cash flow forecast table—all without leaving the spreadsheet. Not only does this significantly boost efficiency, but it also greatly reduces the risk of human input errors.

What excites traders even more is that the upgraded Claude now connects to major global financial data sources, synchronizing real-time prices of various assets such as stocks, bonds, futures, and foreign exchange, along with macroeconomic indicators. Whether tracking market reactions to the Federal Reserve's interest rate decisions or dynamically adjusting hedging strategies, users can make decisions based on data updated in seconds, truly achieving “the market changes, and AI knows first.”

The true demonstration of professional depth lies in the Agent Skills intelligent skill set tailored for financial scenarios:

- Automatically parse 10-K/10-Q financial statements, extract key metrics, and generate comparative analysis;

- One-click completion of comparable company valuation (Comps) and precedent transaction (Precedents) research;

- Intelligent organization of due diligence packages and automatic highlighting of risk points;

- Even capable of generating draft industry reports in the format of Goldman Sachs or Morgan Stanley.

This means that projects that previously required team collaboration for days can now be completed by a single person in just a few hours with the help of Claude.

AIbase observed that this upgrade marks a shift in AI's application in the financial field—from “auxiliary queries” to “active execution.” When Claude can think, model, and write like a senior analyst, the role of humans will shift to higher-level judgment and strategy formulation. This is not just the evolution of tools, but a redefinition of work paradigms.