At today's World Artificial Intelligence Conference, Ant Digital officially launched its latest developed financial reasoning large model - Agentar-Fin-R1. This model is built upon Alibaba's Tongyi Qianwen Qwen3 large model, focusing on the professionalism, reasoning capabilities, and secure compliance of the financial industry, aiming to provide financial institutions with a "reliable, controllable, and optimized" intelligent core.

Agentar-Fin-R1 has shown excellent performance on multiple authoritative evaluation benchmarks. It not only surpasses open-source general large models of the same size such as Deepseek-R1, but also achieved outstanding results in financial large model evaluations such as FinEval1.0 and FinanceIQ. This achievement indicates that Ant Digital has entered a new level in AI applications within the financial sector.

To meet the needs of different financial institutions in diverse scenarios, Agentar-Fin-R1 provides two versions with 32B and 8B parameters, as well as non-reasoning versions with 14B and 72B parameters. Zhao Wenbiao, CEO of Ant Digital, stated at the launch event that there exists a "knowledge gap" between general large models and practical industrial applications. Therefore, building professional financial large models is an inevitable path for the deep integration of finance and AI. In the future, the depth of application of financial large models will become a key factor in the competitiveness of financial institutions.

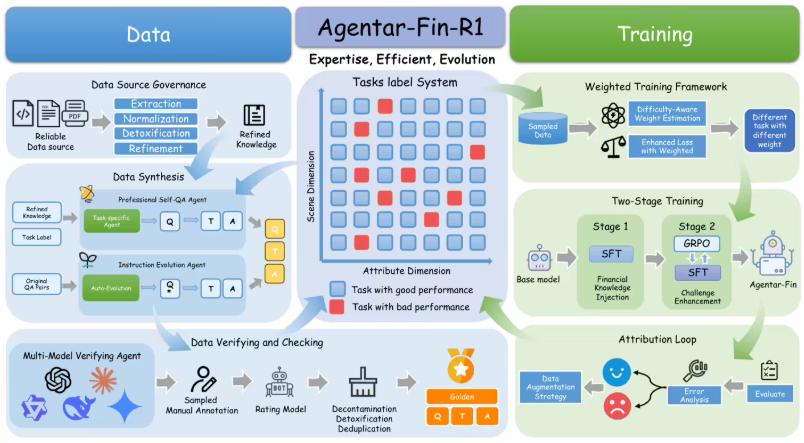

In terms of data, Ant Digital has built the most comprehensive financial task classification system in the industry, including six major categories and 66 subcategories, covering all financial scenarios such as banking, securities, insurance, funds, and trusts. By leveraging trillions of financial professional data corpus and expert-annotated financial long reasoning chains (CoT) construction mechanisms, Agentar-Fin-R1 demonstrates its "innate understanding of finance" capability.

Today, Ant Digital has helped a bank in Shanghai develop an "AI mobile banking" application, providing users with natural dialogue-based financial services. This "conversation as a service" model has not only improved the satisfaction of elderly customers but also increased monthly active users by 25%.

Paper link: https://arxiv.org/pdf/2507.16802