A startup called Lava Payments is trying to challenge payment giants by building solutions specifically for the modern internet, allowing AI agents to handle transactions on behalf of users. This idea came from Mitchell Jones, the founder, after he left a fintech startup called Lendtable, which was incubated by Y Combinator, and began experimenting with AI technology.

Jones discovered the potential of building a system that makes it easier for AI agents to pay and more developer-friendly. While experimenting with AI applications and trying to build what he thought were simple features, he realized that he had spent over $400 just to create a basic form-filling agent.

Jones said, "I kept running into the same problem. I was using the same underlying models and tools, but I had to go through different wrappers or platforms." Each time, he had to start a new subscription, re-authenticate, and pay separately, "even though I was already paying for access to the core model."

He continued, "It felt fundamentally broken. I didn't want to keep buying access to the same thing under different wrappers. I wanted a single wallet, a single set of credits, and the ability to switch between tools and providers without starting over each time, so I could pay based on usage."

So he decided to launch Lava Payments as a solution. Lava is a digital wallet that allows merchants to use credits to facilitate transactions.

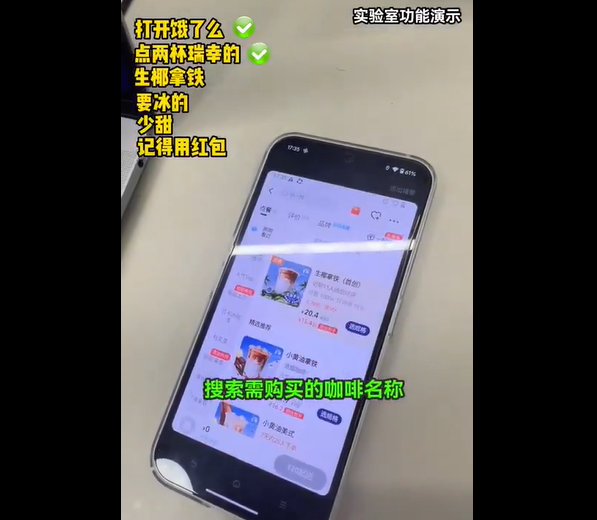

The core idea is that a universal set of credits that works across merchants and services makes it easier for autonomous agents to make payments without human intervention. The way it works is this: Merchants can enable the Lava wallet for customers and upload credits. Once the customer completes this step, they can use these funds in any merchant that accepts Lava, as well as in base models like GPT and Claude, on a "pay-as-you-go" basis, Jones said.

Therefore, users don't have to pay separately for each tool, but instead purchase a one-time credit package, which AI agents can directly deduct when performing various tasks. There's no longer a need to ask users to approve each transaction individually.

Jones said, "Without Lava, agents can't move smoothly on the internet because they are constantly blocked when they need to pay." He used Google as an example, saying that whenever someone opens Google Maps, they don't have to pay Google for the map because they've already paid Verizon and AT&T for internet access.

On Wednesday, the startup announced a $5.8 million seed round led by Lerer Hippeau.

Other companies in this space include startups like Metronome.

Jones spoke about product differentiation, saying, "We see the world as highly interconnected. We're truly focused on building solutions for an agent-native economy."

Jones was born in a working-class family in Dayton, Ohio, and he said his parents always told him that the best way to succeed was to work hard, save money, and get a good education.

In an interview with TechCrunch, he recalled, "You know, these are things most people are told." Jones took the advice seriously. He got a good education (Yale University), landed a good job (Goldman Sachs, Meta), and then started some companies (fintech company Parable and Lendtable, which was part of the YC S20 batch).

Jones said that he met the main investors of Lava mainly because he was classmates with Will McKelvey, a current investor at Lerer Hippeau. He said McKelvey had been following his career and had been looking for an opportunity to collaborate, and Lava Payments was that opportunity.

Other investors in this round include Harlem Capital, Streamlined Ventures, and Westbound. The new funding will be used for hiring, product development, and developing marketing strategies.

Overall, Jones is ready to make Lava the "invisible layer" powering the AI network, especially as AI agents increasingly appear in checkout processes.