Figma, a cloud collaboration design software company based in San Francisco, has officially submitted its IPO application to the U.S. Securities and Exchange Commission (SEC), planning to list on the New York Stock Exchange (NYSE) under the stock ticker FIG. According to the latest information, Figma's target valuation is approximately 20 billion dollars, and it is expected to become one of the most anticipated tech IPOs in 2025. This article was compiled by the AIbase editorial team, based on publicly available information, providing an in-depth analysis of Figma's listing background, technological innovation, and market prospects.

The Rise of Figma: From Design Tool to Product Development Ecosystem

Figma was founded in 2012 by Dylan Field and Evan Wallace, initially positioned as a browser-based interface design tool, emphasizing real-time collaboration and cloud storage. Its core product allows designers, developers, and product managers to collaborate on the same platform, revolutionizing the traditional single-machine, asynchronous workflow of design software like Adobe XD and Sketch. As of March 2025, Figma has 13 million monthly active users, two-thirds of whom are not traditional designers, including product managers, marketers, and content creators, demonstrating its wide industry applicability.

Figma's product line is also continuously expanding:

- Figma Design: Core design tool, supporting UI/UX design and prototyping.

- FigJam: A digital whiteboard tool launched in 2021, suitable for team brainstorming and cross-departmental collaboration.

- Dev Mode: Launched in 2023, it helps developers quickly convert designs into code.

- Figma Sites: A Beta version introduced at the 2025 Config conference, allowing users to directly publish designs as websites with content management system (CMS) functionality.

In addition, Figma's investment in artificial intelligence is significant, with AI mentioned over 200 times in its S-1 filing, indicating its strategic focus. The company has already launched AI-driven features such as Figma Make, which can quickly generate interactive prototypes, and plans to further integrate generative AI to optimize the design process.

Financial Performance: Strong Growth Supports High Valuation

Figma's financial data provides strong support for its high valuation. According to the S-1 filing:

- 2024 Revenue: $749 million, a 48% increase from the previous year.

- Q1 2025 Revenue: $228.2 million, a 46% increase from the same period last year, with net income of $44.9 million, tripling compared to $13.5 million in the same period last year.

- Customer Base: It has 1,031 clients with annual revenue contributions exceeding $10 million and 11,000 clients with annual revenue contributions exceeding $1 million.

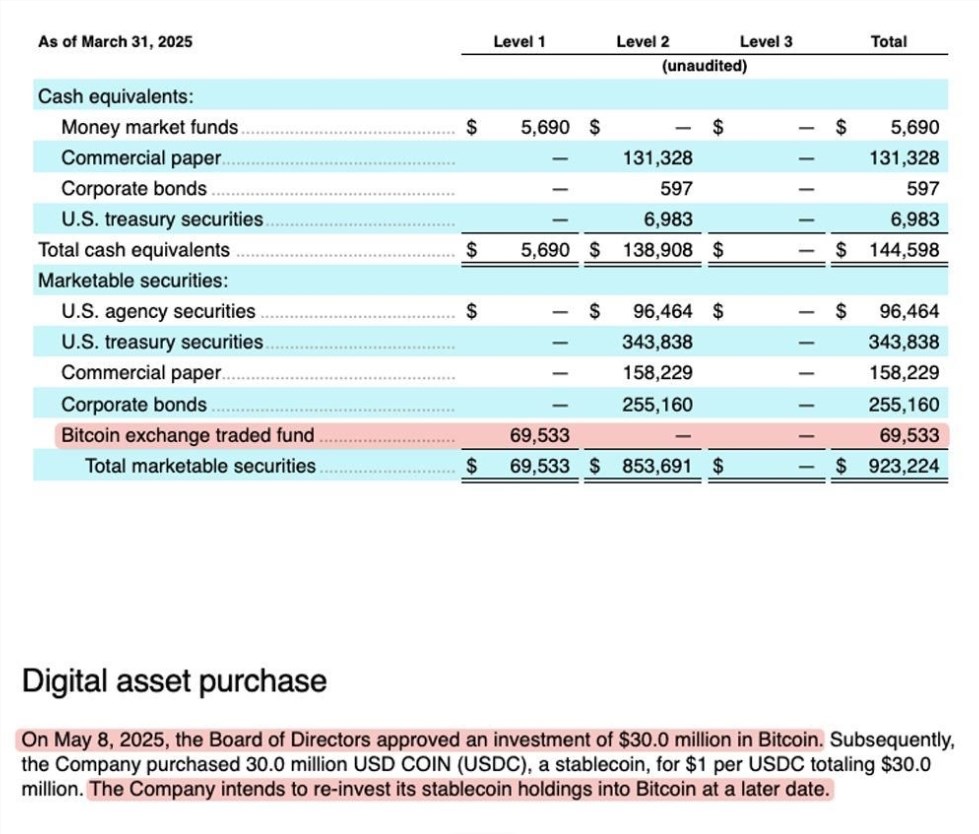

- Cash Reserves: As of March 2025, Figma holds $1.54 billion in cash and equivalents, no debt, and has invested about $69.5 million in Bitcoin spot ETFs, with plans to add another $30 million in Bitcoin investments.

Although Figma reported a net loss of $732 million in 2024 due to one-time expenses such as employee stock compensation, it achieved profitability in the first and second quarters of 2024, showing its financial stability. Its 91% gross margin and 150% net dollar retention rate further highlight its strong business model.

IPO Background: From Adobe Acquisition Failure to Independent Listing

In 2022, Adobe had announced its intention to acquire Figma for 20 billion dollars, but the deal was canceled in December 2023 due to opposition from EU and UK antitrust regulators. Adobe paid Figma a 1 billion dollar breakup fee. This failed acquisition not only provided Figma with ample cash flow but also accelerated its independent development. In May 2024, Figma's valuation in the secondary market reached 12.5 billion dollars, and in April 2025, it rose to 17.84 billion dollars. This IPO targets a valuation of 20 billion dollars, matching Adobe's previous valuation but reflecting market confidence in its growth potential.

Figma's IPO comes at a time when investor enthusiasm for tech stocks is high. In 2025, successful IPOs of AI infrastructure companies such as CoreWeave and Circle (with increases of 290% and 519%, respectively) have created a favorable environment for Figma. The company plans to raise approximately 1.5 billion dollars through this IPO, which could make it one of the largest tech IPOs of the year.

Market Competition and AI Strategy

Figma's main competitors include Adobe XD, Sketch, Canva, and emerging AI-driven design tools such as Lovable. Its 90% share of the design tool market is attributed to its product-led growth (PLG) model and low learning curve. However, the rapid development of AI technology also presents challenges. Figma acknowledges in its S-1 filing that continuous investment in AI is necessary to maintain competitiveness, or it may be surpassed by emerging technologies.

To address this challenge, Figma has enhanced its AI and content management capabilities through acquisitions (such as Payload and Modyfi in 2024) and collaborations with entities like Google for Education to expand its educational market. Additionally, Figma has obtained FedRAMP Moderate certification, entering government and public sectors, further broadening its revenue sources.

Future Outlook: Globalization and Enterprise Market

Figma's future growth strategy focuses on:

- Global Expansion: Currently, more than half of its revenue comes from outside the United States, and it plans to further expand into Europe and Asia.

- Enterprise Customers: Attracting more large customers, such as Microsoft, Airbnb, and Uber, through advanced analytics, security, and customization features.

- AI Innovation: Continuing to invest in generative AI to optimize design and collaboration processes.

CEO Dylan Field stated in his letter to investors: "We will continue to take bold steps, including expanding our influence through acquisitions." This strategy indicates that Figma is not satisfied with just the design tool market but aims to become an end-to-end product development platform.