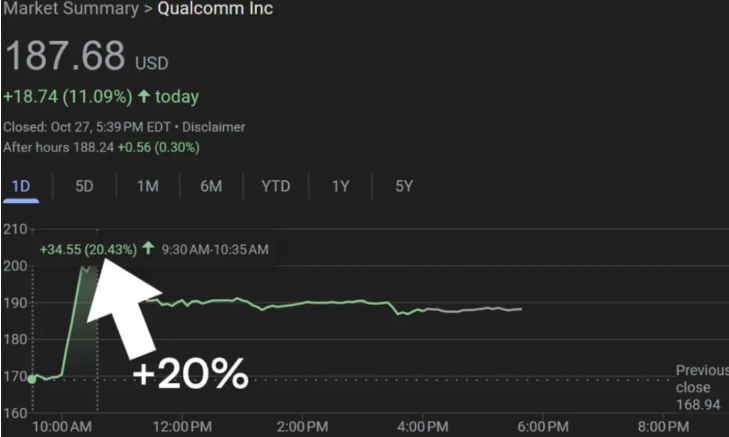

Recently, this tech giant, renowned for its mobile chip, announced the launch of two new chips designed specifically for cloud AI inference: AI200 (to be commercialized in 2026) and AI250 (to be released in 2027), marking a key shift from a terminal chip manufacturer to a full-stack AI infrastructure player. The news caused Qualcomm's stock to surge over 20% in a single day, the largest increase since 2019, with the capital market showing its confidence with real money.

Focusing on Inference Scenarios, Breaking Through with Energy Efficiency and Cost

Differing from NVIDIA's comprehensive approach that covers both training and inference, Qualcomm has chosen to focus on the large model inference market, emphasizing three advantages: "low total cost of ownership (TCO) + high energy efficiency + large memory."

- The AI200 supports up to 768GB LPDDR memory, and can be delivered as an independent accelerator card or an entire rack system, optimized for large language models and multimodal inference, meeting enterprises' needs for high concurrency and low latency inference;

- The AI250 goes a step further by introducing a near-memory computing architecture, claiming to increase memory bandwidth tenfold while significantly reducing power consumption, setting a new benchmark for energy efficiency in ultra-large-scale deployment.

This strategy directly addresses current data center pain points: as the cost of model inference surges, companies urgently need cost-effective, low-power specialized solutions rather than simply chasing peak computing power.

A Decade of Preparation, Hexagon NPU Becomes a Key Engine

Qualcomm did not act on a whim. Since 2019, it has accumulated experience in cloud chips within the Internet of Things and 5G edge computing. Its core weapon is its self-developed Hexagon Neural Processing Unit (NPU). After years of iteration, Hexagon has evolved from a mobile AI accelerator into a high-performance inference engine scalable to data centers, becoming the technological cornerstone for Qualcomm's challenge in the cloud market.

Major Players Targeting NVIDIA, Market Reaches a "Decentralization" Turning Point

Although NVIDIA currently holds about 90% of the AI chip market share, customer demand for supply chain diversification is growing stronger. Cloud providers such as Google (TPU), Amazon (Trainium/Inferentia), and Microsoft (Maia) have already developed their own chips. Qualcomm's entry provides a new choice for third-party independent suppliers. McKinsey predicts that global data center investment will reach $6.7 trillion by 2030, a blue ocean capable of accommodating multiple players.

Qualcomm has already secured its first major client: the Saudi AI startup Humain plans to deploy a rack system based on AI200/AI250 in 2026, with a total power of 200 megawatts, equivalent to the electricity consumption of a small city.

Can It Challenge the Dominant Player? The Key Lies in Ecosystem and Implementation

Challenging NVIDIA, chip performance is just a ticket to the game. Software ecosystem, developer support, and actual deployment results are the key to victory. Whether Qualcomm can replicate its ecosystem integration capabilities in the mobile field, building a complete inference stack from tools to frameworks, will determine whether it can truly capture the premium market.

Regardless, Qualcomm's strong entry has introduced a significant variable into the AI chip battlefield. When the "king of mobile chips" is determined to create a storm in the cloud, NVIDIA's moat may no longer be as solid as before.